Do you have credit card debt? If so, how to pay off debt fast has probably crossed your mind many times. Having no debt can give you many options that are not available to you when you have monthly credit card bills. So, becoming debt free should be a priority.

If you have consumer debt, you are not alone. Statistics state that half of all US households carry credit card debt with an average amount that exceeds $15,000.

This post may contain affiliate links. Please read our disclosure policies for more details.

If you are looking for a way to pay off consumer debt, following these five steps will get you on your way to being debt free.

How to Create a Debt Repayment Plan

10 Simple Financial Planning Printables

How to Consolidate Credit Card Debt Quickly

Being free of debt will allow you to think about the future and start living life on your terms.

How To Pay Off Debt Quickly

Paying off debt quickly not only takes a plan, but it takes the mindset that you are going to put getting out of debt ahead of buying things that are not necessities. A person needs a home, food and clothing.

But a luxury apartment, restaurant meals and designer clothing are not necessary. So, to pay off your debt in the fastest way possible, you will need to evaluate every penny you are spending.

1. Make A List Of Your Debts

As debt begins to mount, it becomes easy to stuff unopened bills in a drawer hoping they will somehow take care of themselves, but unfortunately, that will not happen. Before you can get out of debt, you must know where you stand.

This means you will need to get the bills out of the drawer, open them and make a list. You have to acknowledge where you are at this time to be able to change it. Looking at a lot of debt in the form of a stack of bills can be very scary, but it will get better.

Everyone that got out of debt had to look at every one of their debts before they became debt free.

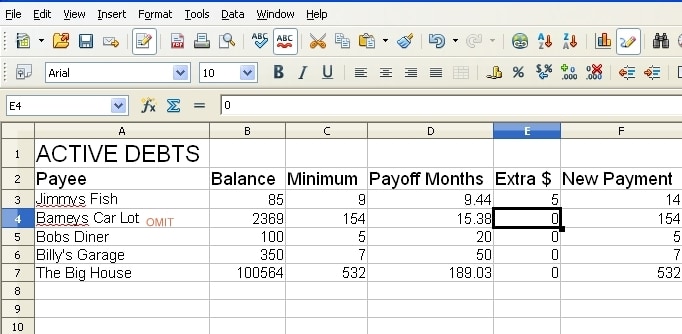

Now that all the bills and credit card statements are out of their hiding places…make a list. Who do you owe, what is the total amount you owe them, how much do you have to pay each month, when is the payment due?

You can use a spreadsheet for creating this list and organizing the information. There are also many printable planners available online as well as interactive planners.

Any one of these listing methods will work. The action item in this step is to make a complete list of all of your debts.

Tip: Once you get to this point, it is time to make a promise not to incur any more debt while you are paying off your consumer debt. The goal is to reduce your debt as quickly as possible. That will not happen if you keep using your credit cards. If cutting them up is the only way to avoid using the cards, DO IT!

2. Negotiate Lower Interest Rates

The first thing you will want to do is negotiate lower interest rates. Most credit card interest rates are at least 14% with many of them as much as 30%.

You can read the horror stories on the back of your credit card statements about how long it will take you to pay your account in full if you make only the minimum payment each month.

Call your credit card companies one at a time and ask them to lower your interest rate. There is nothing wrong with letting them know that if you do not get a lower rate you will be forced to file bankruptcy.

If you are paying off a $1000 credit card bill with a 25% interest rate and making a $50 a month payment, it will take you 27 months to pay off the $1000 and you will have paid $307 in interest dollars.

If you take the same $1000 bill and the credit card company lowers the interest rate to 12% and you make the same $50 monthly payment, the debt will be paid in full after 23 months with $121 in interest paid.

Getting interest rates reduced can save you hundreds of dollars and many months of time in the journey towards debt freedom.

A debt management company can help you get lower interest rates, if you don’t want to do it on your own or your credit card companies will not help.

3. Create a Repayment Plan

This step requires you to select an order for repaying your credit cards. One plan is to focus on the card with the highest interest rate first. Others say you should pay off the card with the smallest balance first.

Paying off the card with the highest interest rate first will cost you less money in the long run. Some people find crossing items off a to-do list motivating. That is why paying the lowest balance card off first is sometimes suggested.

Pick the repayment order that works best for you. The action item in this step is to pick an account and focus on getting it paid off.

Pay minimum payments on all accounts except the one you have chosen to focus on. Pay as much as your budget will allow on that card.

Follow this process each month until the focus account has been repaid. Pick the next account that will be your “focus account” and repeat the process. Each time you pay a card off, you will choose a new focus card.

You should be snowballing payments as you go through this process. Adding the amount you were paying on the paid off account to the next focus account (snowballing), will have you on track to be debt free as quickly as possible.

4. Reduce Your Spending

Look at where your money is going and evaluate how you can cut back on your spending. Every dollar that you can eliminate from your spending is that much more that can go towards paying off your debt.

Challenge yourself to cut unnecessary spending by a certain percentage or dollar amount. You will be surprised where you can cut expenses if you really try.

There are a lot of monthly expenses that we have that we believe we cannot do without. If people did not have it 100 years ago, chances are, it is not a necessity now.

Cable TV, cell phones, gym memberships, internet are just a few of these things. If you look through your expenses, you can probably find a few.

5. Make Extra Money

Start by looking at what you have in your home that you can sell. You can take a picture of a household item and have them for sale online in a matter of minutes with sites like Ebay, Facebook and Let Go.

You don’t have to sell all your worldly processions, but if you have items that have never been taken out of the boxes…this could be a sign that it is time to downsize.

If you don’t have things to sell, start thinking about what you can do that will bring in extra money. Take a part-time job. Start a business that does not require a large start-up fee.

Can you write? Can you tutor? Do you have a lawnmower? Look at the skills you have and figure out how to use them to make money.

Take any extra money that may come your way (income tax return, bonus, gift money) and put it towards paying off your debt.

Develop a healthy obsession with becoming debt free. Make it a priority! Cutting your spending and increasing your income are the keys to paying off your debt quickly.

Wondering how you can get out debt with bad credit, a debt management company can help.

These companies are nonprofit and can not only help you get your interest rates lowered and develop a repayment plan, they also provide education on staying debt free and saving money.

Whether you choose to enlist the help of a debt management company or pay off your debt on your own, the first step is to acknowledge the debt and get started. Being debt free will reduce your stress and give you the motivation to live your best life.