What is a debt repayment plan? It is a plan that is recorded on paper or digitally that is your road map to paying off debts that you have. These debts can range from credit cards to a mortgage.

Your debts may also include student loans, medical bills, car loans, payday loans, store credit cards, etc. Debts come in a lot of forms in today’s society.

So, where do you start creating a debt repayment plan? This is how I am doing it with the debt I have left. Hopefully, this plan will work for you.

1. Set Some Financial Goals

You may not think this step is essential to a debt repayment plan and I guess it really isn’t. But this is the step that is going to keep you motivated to be aggressive in paying your debts off.

Even if you take a sheet of paper and write down a few things you would like to have or do as a result of being debt free, it can give you the motivation to have a healthy obsession with becoming debt free.

You can take your financial goal setting to the next level and create a visual aid, such as; a storyboard or a pinterest board. My goal is to allow myself to have more free time.

This means eliminating all unnecessary expenses and creating an income other than my corporate job.

2. List Your Debts

Making a list of your debts means listing all your debts. Financial experts recommend you also include your mortgage even if you do not plan on making it part of the debt repayment plan.

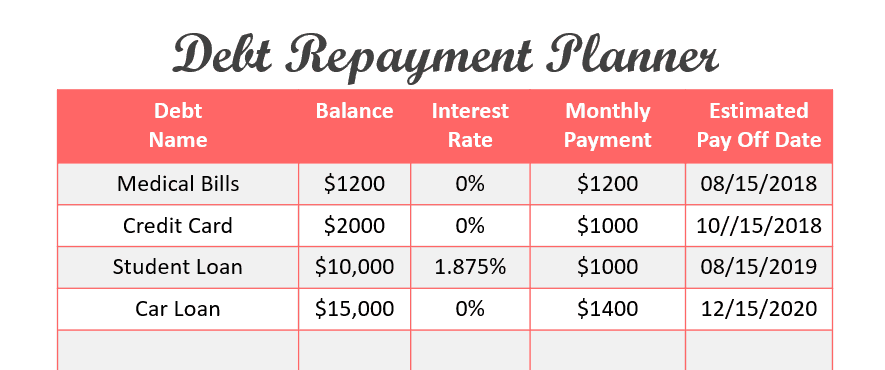

Your debt listing should include your minimum monthly payment, interest rate and the total balance of the debt. This list will be the starting point for organizing a repayment order for your debts. This is what mine looks like at the time of this writing.

The student loan and car lines have estimates for what the balances will be at the time I begin the snowballed payments. I will make a monthly payment of $170 on the student loan and $400 on the car loan until the loans listed above them are paid off.

When the the medical bills and credit cards are paid off, the student loan payment will go from $170 to $1,000 and when the student loan is paid off, the car loan payment will go to $1,400.

3. Prioritize Your Debts

Okay, now that you have a list of the debts you are going to work at repaying, it is time to choose the order of your debt repayment. Some people suggest you you repay the loans with the largest interest rate first and when that one is repaid, choose the next highest interest rate.

Others will suggest that you repay the debt with the smallest balance first and continue paying them from smallest balance to largest. At the end of the day, it really doesn’t matter what order you choose.

My recommendation is to pick the order that is going to motivate you the most to keep paying off the debt aggressively. My order is shown above. It is smallest to largest, but what will motivate me the most is when I can completely cross two items off this list.

4. Find Extra Money to Pay Your Debts

This step can have a lot of flexibility. But if you really want to be aggressive, you will look for ways to reduce your expenses as well as make extra money. I am not much of a cash person and I rarely use credit cards.

That means I can go right to make bank statement and see where I have opportunities for cutting expenses. If you don’t spend much cash, you can also look at your spending habits via bank or credit card statements.

If you are a cash person, you will need to manually track your spending by using a printable tracker or spreadsheet.

Making extra money can come from a part-time job, a side-hustle or by working more hours at your current job.

My plan is to cut back on my spending (I like to eat out). I will do less (a lot less) of it. While I am working on a side-hustle, I would guess it will be a minimum of 3 months before I see any real income from it.

Think about where you can cut expenses and how you can come up with extra money.

5. Focus on One Debt at a Time

You should have identified your first debt for repayment. Mine is at the top of the list above. I will be paying the standard (minimum) monthly on all other debts on my list and as much as I can towards the medical bills until they are paid off.

If your list has “credit card 1” at the top, that will be the bill that gets “as much as your budget allows” and all other listings will get the minimum payment due. Follow this strategy until you have your first debt listed paid-in-full.

6. Move on to the Next Debt on Your List

Once you have paid your first debt in full, it is time to move on to the second debt. Remain paying minimum payments on all your other debts. Your second debt is now your focus debt.

You should be paying its minimum payment amount plus the amount you identified in step 5 as the “as much as your budget allows” amount.

This method should be followed until all your debts are paid off. By the time you get to the last debt, you should be paying the sum of all the minimum payments plus the “as much as your budget allows” identified in step 5.

The snowballing of payments will have you out of debt quickly.

Tip: Put a small amount towards savings each month. Some people will tell you wait until your debt is paid off and then save. However, if your debt repayment plan is several years long, you WILL have unplanned expenses.

Start a small savings account immediately. Even if you save just $25 a week, you will have saved over $1,000 in less than a year. You will feel a sense of relief knowing you don’t have to borrow or charge to cover the expense.

My Debt Repayment Plan

I want to pay the medical bills in the first 30 day. I will have to sell a few things (gift cards, electronics, Vera Bradley purses) to be able to achieve that goal.

The credit card charge is from a large home repair and it is time for that to go. We will be paying $1,000 a month for a two month period.

The student loan – I am already paying $170 a month. The plan is to add $830 a month to it and pay an even $1,000 a month until it is all paid.

This part of the plan will take me through the first year. The plan for the second year is to add the $1,000 being paid on the student loan to the $400 being paid on the car loan.

This brings the amount to be paid on the car to $1,400 a year. If I stick to the plan as outlined, I will have everything paid off in about 2 years.

I have also outlined a stretch goal and that is to take 6 months off of the repayment plan by creating income through my side-hustle (writing articles). If I can add an additional $700 to the last 6 months of payments, I will be done in 18 months.

Follow Along

If you want to follow my progress, check back from time to time. I will update my progress as I go through my debt repayment plan.

Debt Repayment Plan – Update 1

As I have stated many times before, debt can steal your dreams as well as your financial security. So, getting rid of the debt is my top priority. Eliminating a number of small monthly expenses was the first step in creating a debt repayment plan.

The second step step was to put a limit on the amount of money my husband and I spend on eating out. Some months it could go as high as $600 – $800.

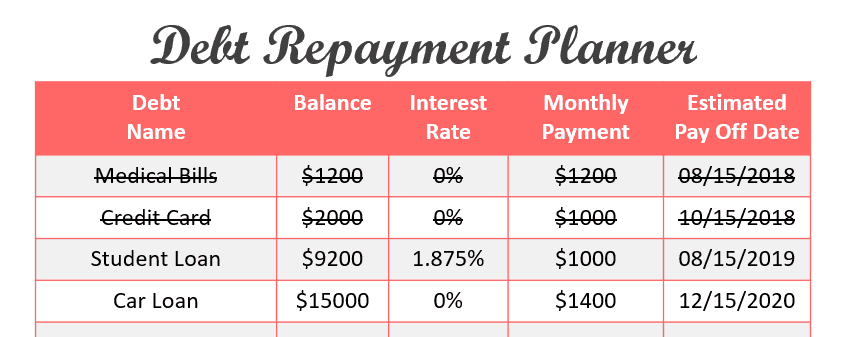

After that, it was time to buckle down and get the debt paid off. I was able to pay the $1,200 in medical bills off in the first 15 days.

The $2,000 in credit card debt was for a pricey repair to another house that we own. It was on a 0% interest credit card. I have been asking my husband to pay it off with money from our emergency fund for several months.

My plan was to pay it off after the medical bills. About a week before I was going to pay the first $1,000, my husband announced that he had paid it off. Woohoo…it was gone.

Now it was time to start paying the student loan. And this is where the real challenge is. One thousand dollars a month is going to be hard to come up with month after month.

I made an $800 payment on the student loan about a week ago. I am holding off on paying the other $200 right now, because I feel like it will leave me short.

My unexpected expenses in the last 30 days was $130 in medical expenses, a $95 dental bill and a $100 vet bill.

Now our debt looks like this:

Could I have paid the $1,000 as planned and paid the $325 in unplanned expenses from our emergency fund? Sure, but I feel more comfortable paying less on the student loan and paying the other expenses out of my paycheck.

I think that a budget should have a certain amount of flexibility. This is the reason I have opted to pay less than planned this month. I still hope to keep my estimated timeline.

On a personal note, I feel like I plan a little bit too aggressively and don’t leave enough money in the budget for incidental expenses.

I will leave my plan to pay $1,000 a month on the student loan unchanged. While it may take me a month or two longer to get it paid off, it is still a plan that is getting me closer to having my debt paid off.