7 Ways to Save Money on Back to School Shopping

While the summer season may still be in full force, the start of the school year is not too far off. In a few weeks, parents will be getting letters in the mail with their children’s room assignments, teachers, and a long list of school supplies.Whether your children...

Swagbucks In-Depth Review – Can You Make Money for Browsing the Web?

Can you really earn money by browsing the web and taking online surveys? If you sign up to Swagbucks you can earn points and redeem them for money. Swagbucks is one of the most popular online survey and rewards program sites. They are receiving a lot of attention, but...

Debt Free Living: 10 Things Debt Free People Do

Is it your dream to be debt free? Well, you are not alone. There are millions of people that practice debt-free living every day.But what makes them different than the other group of millions that carry credit card balances and are loaded with other types of debt?How...

How to Pay Off Credit Card Debt Fast

Do you have credit card debt? If so, how to pay off debt fast has probably crossed your mind many times. Having no debt can give you many options that are not available to you when you have monthly credit card bills. So, becoming debt free should be a priority. If...

17 Ways to Save Money on Groceries

If you are trying to maximize your income, preparing meals are home will be your most cost-efficient way of eating. Not only does cooking at home save money, it is often healthier because the portions eaten are smaller.But even shopping for groceries can be expensive,...

22 Innovative Ways to Make $100 a Day

Are you a stay-at-home mom looking for a way to make a few dollars in the little bit of spare time you may have? Maybe you are a college student that needs a little bit of spending money. Do you have debt that you are trying to pay down quickly? Are you retired and...

How to Save Money to Buy a House

Some say it is the American dream...owning your home. But before you can own your own home, you have to understand how to save money for a home. There are also a number of costs associated with owning your own home. It is more than just a down payment and a mortgage....

Survey Junkie In-Depth Review: Is This Paid Survey Site Legit?

Survey Junkie is one of many sites that pay people to complete various online surveys. There are dozens of these sites. Many of them are legitimate and some of them are a complete waste of time. Sites that offer paid surveys continue to attract new users that are...

How to Sell on Facebook and Set Up Your First Facebook Shop

If you want to sell goods online, Facebook may not be the first marketplace that you think of. Amazon, eBay, and Etsy are a few of the most popular choices for online merchants. However, Facebook is one of the most visited websites in the world. They also have over...

How to Sell on Amazon: A Guide to Selling on the World’s Largest Marketplace

Amazon is the largest online marketplace. While people often think of eBay, Etsy, and Shopify when it comes to selling goods online, Amazon may provide the perfect platform for establishing your eCommerce business. However, learning how to sell on Amazon requires a...

How to Sell on Etsy: Beginner’s Guide to Selling Handmade Goods on Etsy

Etsy is one of the leading marketplaces for handmade treasures and a potentially lucrative platform for you to make money.Learning how to sell on Etsy is not hard.However, if you want to know how to make money on Etsy, you need to take the time to plan your shop and...

How to Sell on eBay and Start Making Money

If you want to make money online, eBay provides a useful platform. You can sell items that you obtain at low prices to make a profit. Selling on eBay can be a lucrative side career. If you stick with it, you may even be able to give up your day job. However, it will...

Credit Card Financing – How To Decide If It Is For You

Credit card debt not only drains you financially, but it can drain you mentally as well. You worry regularly as well as lose sleep at night wondering how you are going to dig your way out from under a pile of debt. Consumer debt help can come in a number of different...

How to Save $10,000 in a Year

Life will constantly remind that you need to have extra money set aside for the unplanned surprises that come along. Statistics say that even a $500 unplanned expenses will be a hardship for most families. Think about what $1,000 could do for you when an unplanned...

How to Plan Your Short Term Financial Goals for 2019

Setting financial goals is a big part of reaching financial freedom. Experts say you are more likely to achieve goals if you put them in writing and monitor them regularly. With the new year upon us, it is time to look at your short term financial goals (what you want...

How to Make a Simple Budget Using the 50/30/20 Method

Budget...just the sound of the word makes me feel uneasy. It gives me a feeling of restriction and no fun, but really it is not that at all. A simple budget is one small part of your journey to financial freedom. It is what will help you payoff your debt as well as...

Should You Pay Off Your Mortgage Early or Invest?

Owning a home...for some, it is the American dream, but along with this dream comes a mortgage. In many cases, this means a payment for 30 years. Thirty years can seem like a lifetime when it comes to making a payment each month that likely exceeds $1000. However,...

5 Amazingly Simple Tips for Financial Success in 2019

As the new year is right around the corner, our thoughts turn to what we are going to do this year that we did not do last year. Why not make this your year by doing the things to it takes you to be successful financially. Being financially successful isn’t rocket...

How to Stop Living From Paycheck to Paycheck

Getting a paycheck is one of the most rewarding things in our lives. Without it we would not have most of things we have and would be without many necessities. A paycheck puts food on the table, a roof over our heads and clothes on our backs. These are just the simple...

The Minimalist Project: Declutter Your Closet

The longer I go through life the more I embrace the minimalist way of living. There is a reason Mark Zuckerburg and Steve Jobs opted to wear the same neutral colors every day. The fewer useless decisions you are forced to make each day, the sharper you will be when it...

Should I Pay Off Debt or Save Money?

When the question of money comes up and the discussion turns to paying off debt vs saving money, which should you do first? First off, I don’t necessarily think there is any right or wrong way to answer this question. It is more about what is right for you and where...

10 Online Businesses You Can Create In Less Than A Week

It seems everyone is looking for a way to make extra money or start an online business. With the era of working your whole life for large corporations long gone, being in control of your own financial destiny is a great idea. If you had to make $1,000 in the next 30...

7 Tips for Living a Minimalist Lifestyle

If you spend much time online reading personal finance sites, it will not be long before you start coming across information and personal stories about minimalism. People who are successful and live a “zen” lifestyle all talk about minimalism and its benefits. In a...

6 Characteristics of 6 Figure Income Earners

Making a 6-figure income is easier than it used to be just because there are more mainstream jobs that have a 6-figure annual income. But not everyone wants to punch a time clock or work in a corporate environment. If your dream is to have a 6-figure income and not be...

10 Places You Can Sell Used Electronics for Money

We live in a time where everyone has electronic devices. You would have to look a long time to find a person that does not own a cell phone. Many people not only have cell phones, they have laptops, tablets, game consoles and the list goes on and on. But what you do...

12 Creative Money Challenges to Increase Your Net Worth

Wanna achieve a goal? Challenge yourself! Write down a money challenge goal, set a time to achieve it and create a fun tracker that will let you track your progress. It is that simple. At least in theory, it should be. Whether you're a professional money manager or...

8 Simple Ways to Save Money During the Holidays

Christmas is a time of celebration, family and giving. While it can be a lot of fun, it can also be filled with its share of stress. Planning will go a long way when it comes to having less stress and creating an enjoyable time for all. Another holiday concern is how...

What Is Your Money Personality?

What makes some people savers and others spenders? Just because you have always been a spender does not mean you cannot start saving and spend less. And on the flip side, if you save every penny you make, it might be time to loosen the purse strings and start...

The Ultimate Money Mindset Reading List

Personal finance books can range from a step-by-step guide for getting out of debt to a plan for saving for retirement and everything in-between. If you are going through something in your life or just want to gain more knowledge, reading a book is a great way to do...

8 Habits That Will Keep You Broke

Have you come to the end of the money and it is not time for your paycheck yet? Is this a recurring problem in your life? If so, it may not be about needing more money to live on. It could be about habits you have developed that are keeping you in the poor house. I...

7 Books That Can Help You Get Out of Debt

Getting out of debt is not an easy task. Personal finance books about eliminating your debt provide valuable information. They can also be great motivators. Many debt relief reads give a step by step plan for getting rid of the debt followed by steps for achieving...

Roth IRA vs 401(k)…Which One is Right for You?

Personal financial planning has changed over time as more options for saving for retirement have become available to individuals. If you compare a 401(k) vs Roth IRA, is one better than the other? Can you have both? There are a lot of choices when it comes to...

How to Create a Debt Repayment Plan

What is a debt repayment plan? It is a plan that is recorded on paper or digitally that is your road map to paying off debts that you have. These debts can range from credit cards to a mortgage. Your debts may also include student loans, medical bills, car loans,...

Are These Stupid Excuses Keeping You in Debt?

Point blank, debt can steal your dreams. Having a mortgage or student loan debt is one thing, but having consumer debt will limit your options in life. The best way to handle it is to repay it aggressively. Sometimes that is much easier said than done, especially if...

10 Best Paid Survey Sites for Making Extra Money

Taking paid surveys can be a great way to make extra money. And the best part about taking surveys is it can be done while you are waiting in line at Starbucks. When it gets right down to it, there are a lot of creative ways you can make money from your phone. I take...

5 Simple Steps to Setting Financial Goals

Setting financial goals…it is the first step to making your dreams come true. It is the fun part of financial planning. You can put down on paper exactly what you want out of life. The challenge may be planning how you are going to achieve these goals. A...

How to Sell Gift Cards for Cash

My mother-in-law gets me gift cards for Christmas and my birthday because they are easy for her. She orders them online and they show up in the mail. Fortunately, the cards are always for my favorite clothing store. I wait until the store has their 50% off sale and I...

8 Things You Should Know About Debt Settlement

You have consumer debt and you know you are in over your head. You are not sure what to do next. Then you hear an ad on the radio that tells you can be out of debt for pennies and there is a little-known secret about credit card debt…you don’t have to pay it all. Most...

17 Ways to Make $1000 Fast (In a Week or Less)

So, you need $1,000 and you need it quickly. Where are you going to get it? It may not be as difficult as you think. Take a deep breath and think about what you can do to put some fast cash in your pocket. Or you can follow one or more of these suggestions to stash...

20 Things We Stopped Buying to Save Money

You wonder how people with low income manage to have nice things and save money on top of it. Simple, they are willing to give up things to save money. They buy only what they need and that is the path we went down to save thousands each year by avoiding unnecessary...

6 Quick and Easy Steps to Living Frugally

Living frugally is one of the best ways to save money. Wondering how to live frugally? It is all about identifying ways to spend less money on expenses and other costs. And it can be done by anyone, no matter where you live. Living frugally is as simple as evaluating...

How to Save Time and Money with CLEP Exams

College can be one of the biggest investments you will make in yourself and your children. If you take the time to plan and look at all your options for getting a college education at the best price, you will find you do not have to spend 10+ years paying off student...

10 Money Saving Tips That Can Save You Hundreds

It seems like almost daily we receive a bill in the mail that needs paid. Or are you one of the lucky few that has your bills setup to pay automatically? Nonetheless, our daily lives are full of expenses and there are times they can become overwhelming. There are even...

How to Consolidate Credit Card Debt Quickly

People have credit card debt for any number of reasons ranging anywhere from trying to keep up with the Jones to being unemployed and living off their credit cards. Whatever the reason, debt can be a huge source of stress as well as a drain on your finances and credit...

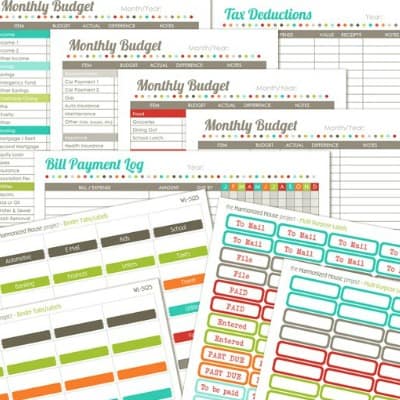

10 Simple Financial Planning Printables

Whether you are trying to get out of debt or just trying to control your household expenses, a budget is essential part of financial planning. You can simplify the process of personal financial planning by putting it all down on paper. Using free budget planning...

8 Creative Ways to Save Money for College

With the exception of buying a home, paying for college will be one of the highest costs in your life. What is the best way to save for college? If you take the time to plan your education, you can do a lot to reduce the cost of education substantially. The Best Way...