Getting a paycheck is one of the most rewarding things in our lives. Without it we would not have most of things we have and would be without many necessities.

A paycheck puts food on the table, a roof over our heads and clothes on our backs. These are just the simple things.

Vacations, the cars we drive and some of our daily experiences all start with a paycheck.

But what happens when you get to the end of the paycheck before you get to the end of the end week?

There is nothing worse than having an expense and that needs paid and having only $10 in your checking account.

It does not have to be that way. I have seen people with very small incomes and they always seem to have money when needed.

I have also seen just the opposite….people with large incomes that always seem to be broke or borrowing money from others frequently.

This post may contain affiliate links. Please read our disclosure policies for more details.

Why Are You Living Paycheck to Paycheck

Most likely someone that is living paycheck to paycheck fits into one of these categories:

1.They don’t make enough to cover their expenses

2.They live beyond their means

If you are in category one and your paycheck is stretched just to cover the necessities, your first step is to take a deep dive into your expenses and see if there is room to cut back on anything.

Cable (if you have it), internet and cell phone bills offer the biggest potential for quick monthly savings. Groceries are also another category where it is easy to save.

Eating out is an unnecessary expense if your paycheck is not making it to the end of the pay period.

Increase Your Income

You may have to increase your income to get out of the paycheck-to-paycheck rut. This could mean looking for another job that pays more.

It could mean taking on a side job or just working a few more hours a week at your current job.

This is not the time to take on debt in hopes of starting a business that will eventually make you money. There are many businesses that can be started for little or no cost.

Living beyond your means can be a little trickier to resolve. In most of these cases, there is a lot of money going to debt.

Credit card debt, large car payments, high mortgage payments and possibly student loan payments can lead to getting to the end of the paycheck too quickly.

How to Start Saving

Ultimately, not living paycheck to paycheck means having money in a savings plan that will be available if something happens and the weekly paycheck is not there.

If you are dealing with scenario 2, you most likely have some debt that needs managed as well as the need to create a savings plan.

Not having some money in saving almost guarantees you additional debt when unexpected expenses arise.

Even if your budget is very tight, you have to find the money to build an emergency fund.

It is this emergency fund that will keep you from living paycheck-to-paycheck and remove the stress that goes along with wondering where the money is going to come from.

Budgeting and Tracking Spending

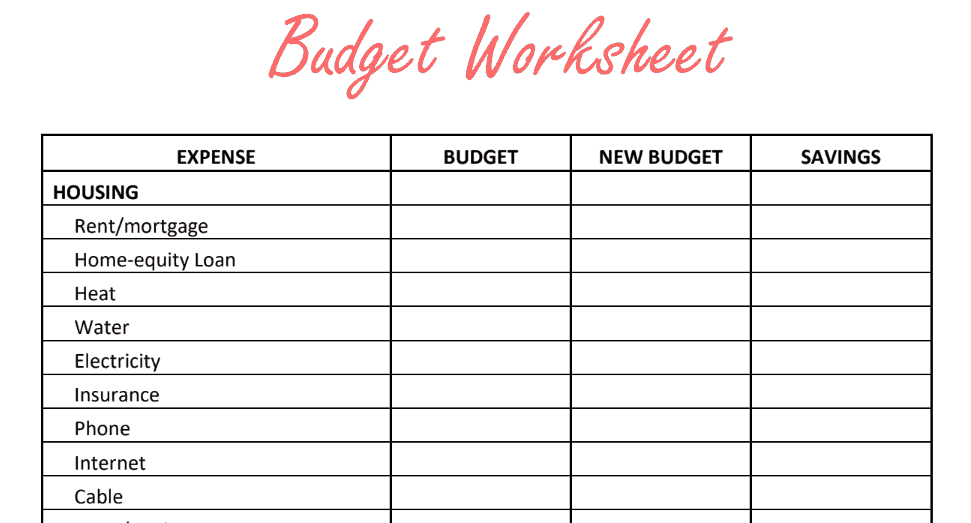

The best way to have extra money available is to create a budget and track your spending. I hate the word budget. It just gives me the feeling of severe restriction.

It is necessary to have a list of what expenses you are paying each month so you can calculate what you have left for saving.

The 50/30/20 method is a great to develop a spending plan even for people who hate to budget.

Simply put, 50% of your monthly income goes towards “needs”, 30% for “wants” and the other 20% goes into a savings plan of your choosing.

If you look at your money this way, it makes it easy to identify a monthly target savings amount. Find your after tax earnings and calculate what your target savings number should be.

If you think there is no way that you can actually put that amount in the bank and still pay your bills, don’t give up. You CAN get there. It just may take a little bit of planning and adjusting to reach the magic number.

Dig Deep

The easiest way to come up with more money if your savings category is falling short is to reevaluate your other budget categories.

Is everything in your needs category truly a need? Your cable bill and gym membership don’t count.

Just an FYI…if you are having difficulty getting to 20% in the savings category and you have expenses listed in your wants category, you should probably rethink your “wants”.

Bottom line…look at everything you are spending money on and cut some of it until you are able to put 20% in savings.

Example: If your needs cost $3,000 each month, you should be saving $1,200 a month and $1,800 is left for the things you want.

Following this plan, you should have $3,600 in the bank after 3 months. At this point, you would be able to cover one month of necessities without a paycheck.

Is one month enough for comfort, for me it is not. The experts (whomever they are) recommend an easily accessible savings of 3 – 6 months and some recommend even more than 6 months.

It is up to you to decide what is a comfortable amount of savings for you and your family.

How to Find the Extra Cash

What if you just cannot get to that 20% savings amount on your income? Get creative and see how you can make more money.

Where can you make an extra $100 a week? It may not be as difficult as you think. There are many ways you can make extra cash these days.

It can be as simple as working a few extra hours a day at a job you already have. Got a hobby you could turn into a small business?

Do you have neighbors that need babysitting, pet sitting, lawn care or window cleaning? Clear your mind and spend a few minutes thinking about your options for making extra income.

In most cases, living paycheck to paycheck is a choice. So is breaking the paycheck to paycheck cycle. Just follow the above steps one at a time.

If you can only put 10% in savings, start there and set a target date for getting to 20%. Many of the aggressive savers target 50% of their income for their savings goal.

Look at it like this…if it is in the bank, you still have the option to spend the money in the future. If you spend it now, it is gone and there is no getting it back.

Breaking the Cycle in Review

I am a “cliff notes” kind of person and if you are the same, here are the simple steps for putting paycheck-to-paycheck living in your past:

1. List your “needs” and “wants” – This part is budgeting 101. Find out what it is costing you to live each month, but know what expenses can be negotiable (either eliminated or reduced). Total the expenses for each category.

2. Calculate 50/30/20 percentages of your income – this step is simple. How much do you bring home each month times .50, times .30 and times .20. The results are the dollar amounts you should be spending on needs, wants and savings.

3. Do you have 20% to save – Based on the answers to the above questions, do you have 20% of your income in your budget to begin saving immediately? If you do, that is great.

You are halfway to your goal of breaking the paycheck to paycheck cycle. You can now skip to step 5, but you want to look at step 4 for so you can eventually save more money.

4. Increase the amount of money available for saving – If you don’t have 20%, make a plan for finding the needed money (cut expenses from “wants” and/or increase your income).

Become aggressive and find additional money to save even if you have 20%. Big bank accounts are sexy (not to mention…stress-free).

5. Monitor and reevaluate your savings plan regularly – make sure you are on track with your savings. Also, plan for big purchases. Bottom line…payments suck! Plan ahead and you may be able to avoid them.

BONUS TIP: Once you get to 20% savings and have some consistency in contributing to your savings plan, set a stretch savings goal for yourself.

A stretch goal is a goal that will be a challenge to reach, such as: 35% savings target…or more. You can also set an increased increment for year, such as: 5% – 10% more this year than the previous year.

Final Thoughts…

In most cases, I would say that living paycheck to paycheck is a choice. I know when I did it, it was. It was a conscious choice to spend any extra money on “things” rather than saving it.

Getting out of the paycheck to paycheck cycle is a process and it has to start somewhere. Start with looking at where your money is going.

This will help you identify where you can cut back and come up with the needed money for saving. It may just be a matter of making some simple changes to your spending habits.

The sooner you get started building your savings the sooner the cycle will be broken as well as the stress of wondering where the money is going to come from to pay that unexpected expense.

20 Things We Stopped Buying to Save Money

10 Money Saving Tips That Can Save You Hundreds

8 Creative Ways to Save Money for College